The advantages and value we create for customers lay the foundation for Sectra’s long-term, sustainable success. High levels of customer satisfaction are the ultimate proof that we deliver value and that Sectra’s services and products markedly improve customers’ operations.

Our progress toward this target is measured on an ongoing basis through internal customer satisfaction surveys based on the Net Promoter Score (NPS) methodology and through leading external evaluations in each area, such as KLAS for our medical IT systems.

Status 2023/2024

High level of customer satisfaction

Our employees—and the corporate culture that shapes their conduct and decision- making—are our main competitive advantage. We therefore aim to ensure we have satisfied employees who perceive Sectra as an attractive, equal-opportunity workplace without bullying or harassment. We want our employees to feel that our corporate culture motivates and inspires them. This is crucial to our ability to recruit and retain the right personnel.

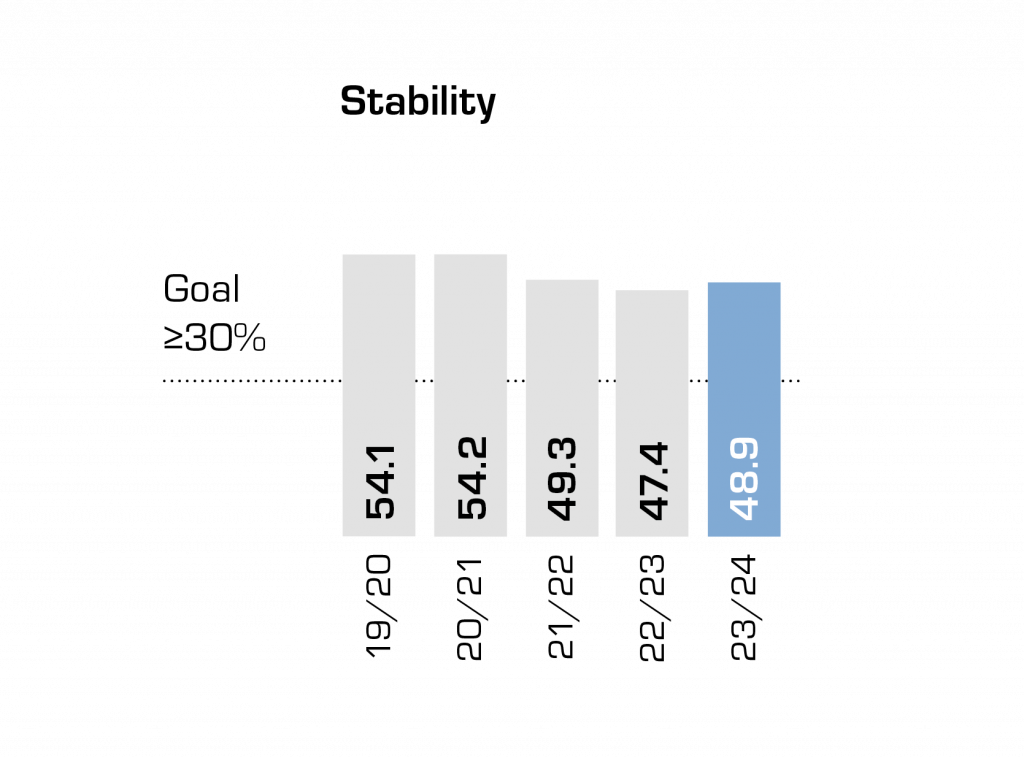

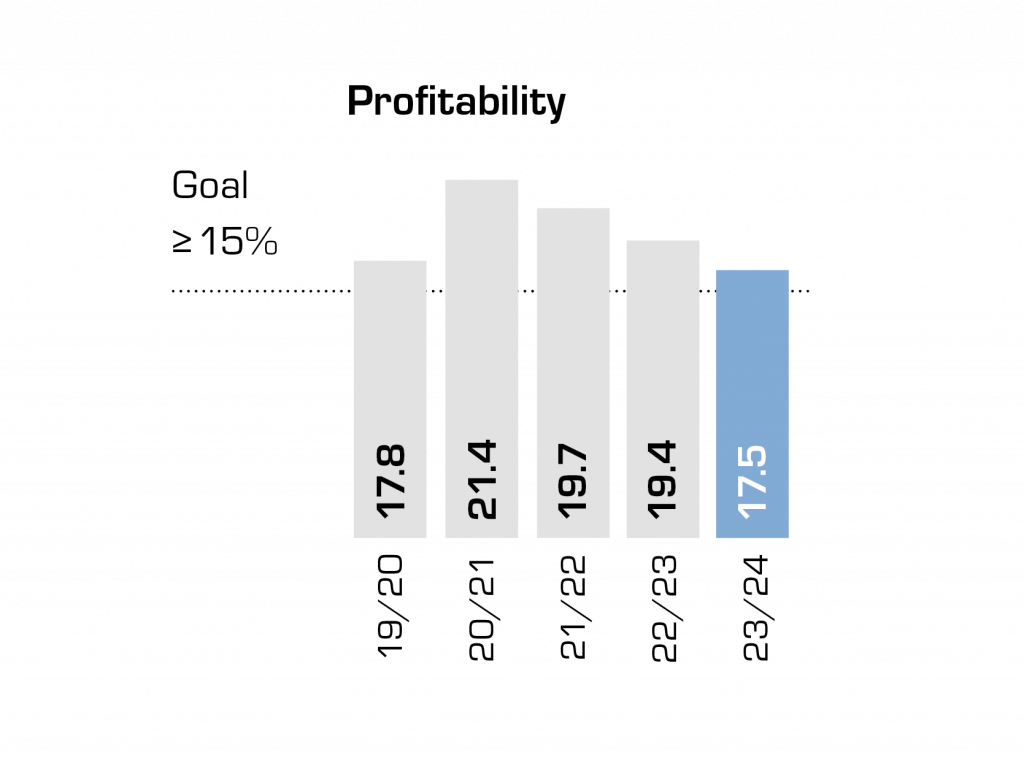

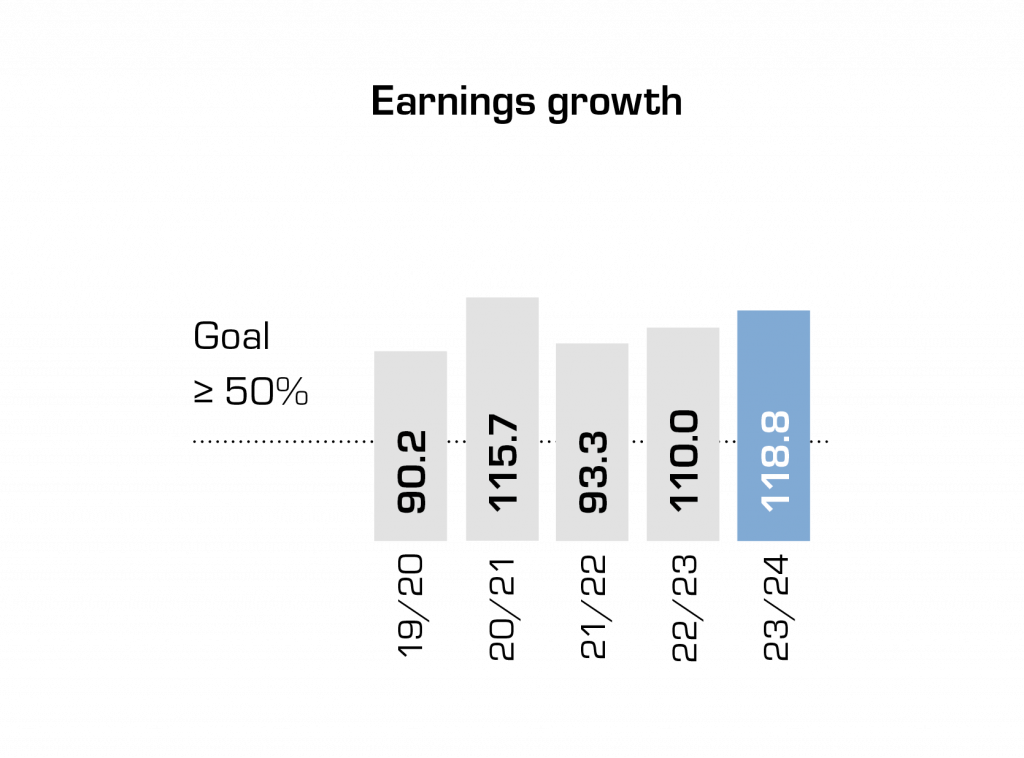

We follow up our progress toward achieving these goals with a number of result indicators, which are based on answers from an annual employee survey. To ensure we have the right process and that we can grow in an efficient manner, we also monitor our operating profit in relation to payroll expenses over time.

Status 2023/2024

Dedicated employees who are satisfied, improving as individuals and doing their best to meet or exceed customer expectations.

Healthier employees and minimal absence due to illness.

Sectra aims to be a future-proof partner for our customers. Innovation and continuous development are therefore important. This target can be summarized in a quote ascribed to hockey great Wayne Gretzky: “Skate to where the puck is going to be.” In other words, we must ensure that Sectra is well-positioned to meet future customer needs.

How well we meet this target is monitored through our annual employee survey with a question about the degree to which the employees agree with the statement “Sectra is innovative”.

Status 2023/2024

Key performance indicator fullfilled.